Public sector pensions: affordable and sustainable

The pensions of public sector workers have come under intense scrutiny in recent months, with ministers and the media describing them as ‘gold-plated’ and ‘unaffordable’. Currently public sector workers are being told they must pay more and work longer for a lower pension – but is this necessary?

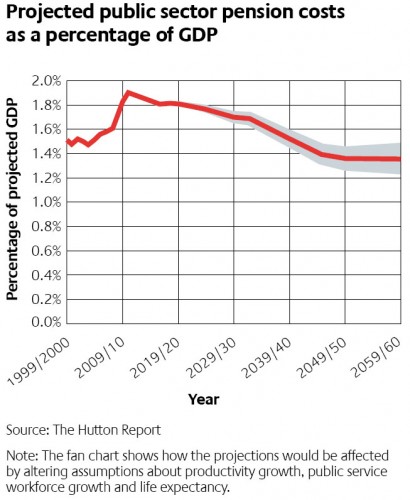

Last year the government asked Lord Hutton to lead an independent commission into public sector pensions. His report showed that their cost is falling over the long-term as the graph above demonstrates; falling from 1.9% of GDP today to a little under 1.4% by 2060.

The graph above does assume the government’s change to pensions’ indexation from the RPI inflation measure to the CPI measure. This could reduce the value of the pensions by over 20% over the course of an average retirement.

However, a report into public sector pensions by the National Audit Office, published in December 2010, does not take into account the indexation change, nor does it make any assumptions about the size of the workforce. It shows reforms agreed between the unions and the government in 2007-08 “reduces costs to the taxpayers by 14%” and “long-term costs are projected to stabilise around their current levels as a proportion of GDP”. So even without these assumptions the costs are still not rising, but stable.

The Hutton report also “firmly rejected the claim that current public service pensions are “gold plated” …the median payment is around £5,600″. This equates to just over £100 per week in retirement. For a woman worker in local government the average pension is just £2,000.

Despite these facts taken from the government’s own commissioned report, ministers have continued to misrepresent public sector pensions and are simultaneously attacking the age at which they retire, how much they pay, and how much they get at the end.

This attack on public sector workers’ pension rights coincides with a pay freeze and, for many, their job being under threat too. A significant minority of workers have said they will opt-out of schemes if they are forced to pay more for a smaller pension. Opting out will mean a larger burden on the taxpayer in extra means-tested benefits.

It is only four years since public sector pensions were significantly re-negotiated with the previous government in a deal that meant for new starters the retirement age rose to 65, and future costs capped. The pensions deal in 2007 was assessed in December 2010 by the National Audit Office, which found it “on course to deliver the saving and stabilise pension costs”, and will save £67bn for taxpayers.

The strike on 30th June gave the issue of public sector pensions increased profile in the media and exposed the government spin about affordability. The government now says it’s about fairness but its proposals will lead to an inequality of misery: unfair to all.

In effect the coalition government is imposing a tax on public sector workers to pay for the mess made by the banks: George Osborne said as much in parliament, “from the perspective of filling the hoe in public finances, we will seek changes that deliver an additional £1.8bn of savings per year in the cost of public sector pensions”.

There is also an ulterior motive in cutting pensions, as it will make public services more attractive for privatisation. The CBI boss John Cridland has said public sector pensions are “a brake on competition and make it harder for those in the private sector to bid for public service contracts”.

As the next chapter demonstrates, private companies have withdrawn providing fair pensions to their employees, and they do not want fair pensions for public sector workers transferred to them.

Trade unions representing millions of workers are fighting this attack through legal action, political campaigning and industrial action.

…saw Francis Maude on the TV at lunchtime and I thought….

I wonder if his pension is secure?

Come to think of it, why is he entitled to a pension after serving as a Member of Parliament?

Serving being the important word here – why is he in Parliament?

Is he there to represent his constituents or is he there as a ‘career’?

They are supposed to be serving their constituency but I think a lot of them see it as a career and have forgotten how they got there and why they are there.

In addition to claiming their pension it seems they can also step immediately into other jobs as consultants. For example:

http://cheriesplace.wordpress.com/2008/09/09/jobs-for-the-boys/

And just to finish off with – information on MPs pay and pensions from the parliament website:

http://www.parliament.uk/documents/commons-information-office/M05.pdf

Off and on there been talk of being more “fair” in our safety net programs over here. But it seems they move so slow.

I believe our social security (government retirement) was sat up in the 1930’s during President Franklin Roosevelt. Lot of things hasn’t change and is still the same and needs to be up dated.

If I have my facts correct the first $50 (32 pounds)(37 euros) you earn on a job you don’t pay into social security fund and anything over $80,000 (51,820 pounds)60, 436 euros) you don’t have to pay anymore in. This is base from year to year. Not a life time.

So my question does your extreme wealthy have to pay in or not?

Editor note…The number facts might of change and I’m not a ware of it.

You briefly mention about inflation. Well President Ronald Reagan during the 1980’s change how inflation is measured. Fuel and food doesn’t count. So for ages people didn’t see an increase in there government retirement.

I’m not sure what our floor or ceiling in retirement pay out. I know some people get in the $200 (129 pounds)(151 Euros) range and some get in the upper $2000 (1,295pounds)(1,510 euro) range.

But we have programs in place to help those who are on super low pensions. Such as our food stamps programs the government send you a card that is to purchase food with.

Also they have different type of housing for the low income retiree.

Once you hit 65 years old and at this time your retirement of social security is slightly under $700 (453 pounds)(528 Euros) a month the government will make the difference up to just under $700 (647pounds)(528 euros) a month.

But lot of these programs you need to be in total despair.

But most people I know gets under $1,000 (647 pounds) (755 euros) a month

There doing an age change our social security on our as well.

I don’t know anyone who belongs to union of any type. My dad worked for railroad and belong to the teamster union here. I know when he retired he receive a check from social security and from the rail road retirement fund.

But in area I live in “unions” are a dirty word.

In present time instead of union involved pension. They have 4 o 1 k which depends on market.

But one thing they recently done to our newly works to jump start the economy. Remember in my last posting “ I believe they take out 8% of your wages and then the employer matches and this goes into our social security fund.” But now instead of taking out 8% there only taking out 4%. This is coming up for a vote to keep it going on not.

Sure it give one a little more in there pocket now but when the 20 to 30 something is going to hurt the most when they reach retirement age. I have two sons in this age group.

Very interesting, thank you

Our government have recently imposed a change to the inflation measure for pensions from retail price index (RPI) to consumer price index (CPI). CPI does not include costs such as housing, mortgage and council tax costs. The net result is a much reduced pension.

They have also changed the terms and conditions of their employees contracts without consultation on pension payouts and retirement age. No matter which way they spin it, that is a breach of contract….