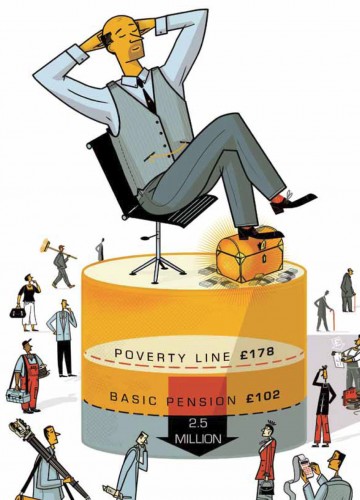

The state pension: below the poverty line

UK pensioner poverty is among the worst in Europe – only Cyprus, Latvia and Estonia abandon their pensioners to a greater degree. France spends over twice as much on pensions as the UK, Germany two-thirds more.

It is simply not true to say that the UK cannot afford better pensions when nearly every other European country does better by their pensioners. The truth is that the value of the state pension has gone from being worth 25% of average male earnings to just 15%.

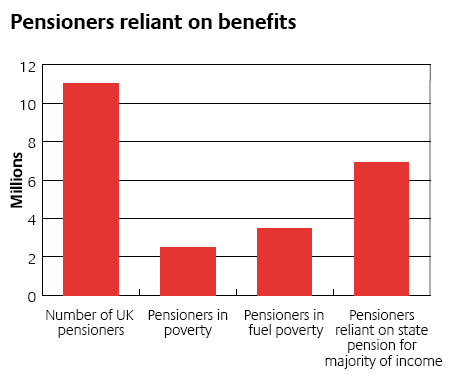

The basic state pension is currently £202 a week, worth only 57% of the government’s official weekly pensioner poverty level of £178. Two and a half million pensioners in the UK live below that level. Even before the above inflation energy price rises this year. 3.5 million pensioners lived in fuel poverty.

Many pensioners therefore rely on means-tested benefits like the pension credit, council tax benefit and housing benefit. However, because of the stigma attached to claiming, over a million pensioners entitled to pension credit do not claim it.

Research by the Left Economics Advisory Panel estimates that the cost of means-tested benefits is £13bn per year. This state of spending would not be necessary if private sector employers provided their staff in the same way as the public sector. However, the proposed cuts to public sector pensions would mean that more and more public sector workers will be eligible for these benefits too.

The state pension age is currently proposed to rise from 65 to 66 by 2020, 67 in 2034 and to 68 by 2044. We believe this is deeply regressive and will have a disproportionate impact on the poorest people.

Although the average person is living longer, there are massive inequalities in life expectancy: men and women in the wealthiest areas live 10 years longer, on average, than those from the poorest areas. The wealthiest can often afford to take early retirement too, whereas the poorest often already have to continue working beyond the state retirement age. Just because we are living longer, it does not necessarily mane we are fit to work for longer: 40& of people aged 65-74 have a disability of illness that limits their quality of life.

Pensioner poverty also intensifies the prejudices that exist over people’s working lives. Women, disabled and ethnic minority pensioners are far more likely to be in poverty because they are discriminated against by employers.

Over several years, governments have allowed companies to abandon their pension duties to their staff, allowed the state pension to fall further and further behind living standards, and today’s government is now attacking public sector pensions too.

We don’t want equality of misery, but fair pensions for all: public, private and state pensions.